Which electric car brands are leading Europe’s mobility shift in 2025?

In March, the EU, UK, and EFTA car market grew 3.2%, but electric car sales surged 23%. By the first quarter’s close, BEVs captured a 17% market share with 124,000 more registrations than Q1 2024. This rapid climb shows how consumer demand, policy support, and charging infrastructure are finally moving in sync.

The success of Europe’s best-selling EV brands is now directly tied to the growth of certified, smart, and reliable EV chargers – making charging networks just as important as the cars themselves.

Europe’s EV Momentum

Before exploring the Electric Car Brands, let’s set the stage. The UK is a prime example of where EV adoption continues to climb. In 2025, the UK surpassed 1.2 million fully electric cars on the road. This growth also fuels demand for Certified EV Chargers, OZEV EV Chargers, and advanced charging technologies like Fast and Super Fast EV Chargers. After all, an EV is only as practical as the charging network behind it.

With government incentives, trusted EV charger suppliers, and wider installation of Home EV Chargers and Public EV Charging Stations, the UK is shaping a future where smart EV charging becomes the norm.

Top 20 Best-Selling Electric Car Brands in Europe 2025

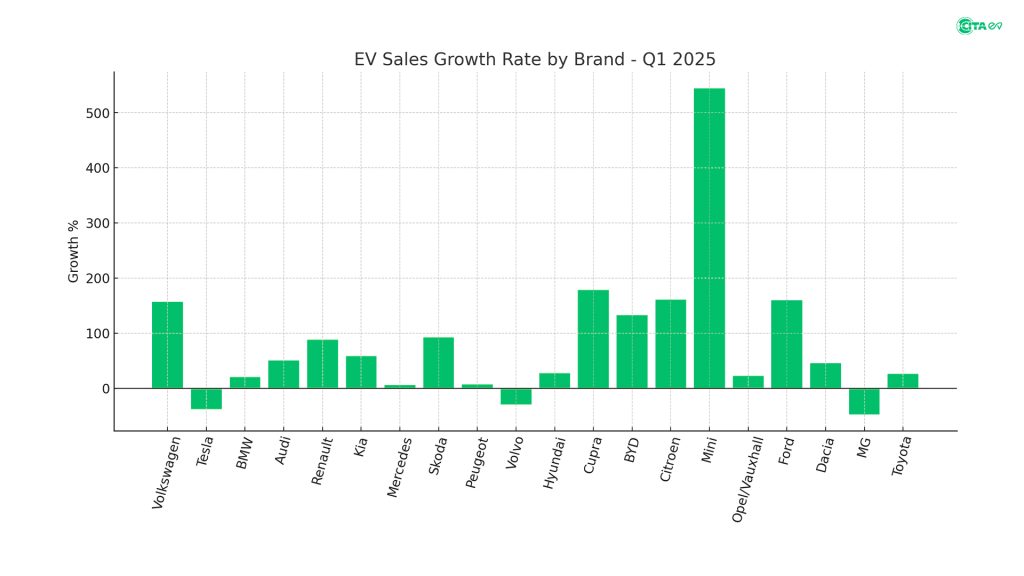

Using March and Q1 2025 registration data across Europe, here are the top 20 brands driving EV adoption, shaping demand, and leading the shift toward sustainable mobility – these are the best-selling EV names you should know.

1) Volkswagen

Q1 Sales: 65,679 (+157%)

Volkswagen has firmly secured its place as the leader in Europe’s EV race. With its ID.3 and ID.4 models dominating family and fleet choices, Volkswagen is proving its long-term strategy to electrify its lineup is paying off.

The brand benefits from wide availability across markets, strong after-sales support, and the ability to balance affordability with innovation. In addition, Volkswagen’s deep investment in battery technology and scalable platforms like MEB positions it as a future-proof choice for buyers and keeps its momentum strong across Europe.

2) Tesla

Q1 Sales: 53,237 (-38%)

Tesla continues to set the benchmark for performance and charging speed, even though its registrations dipped compared to 2024. The Model Y remains Europe’s top-seller among EVs, known for its range, safety, and the Tesla Supercharger network. Tesla’s name recognition keeps it at the center of the EV conversation.

Despite growing competition, Tesla still appeals to buyers prioritizing innovation, frequent over-the-air updates, and unmatched access to its charging ecosystem, giving it a significant long-term edge.

3) BMW

Q1 Sales: 46,557 (+21%)

BMW has established itself as a premium electric player with its i4, iX1, and iX3 models. Customers value the blend of sporty driving dynamics and luxury finishes.

In Europe, BMW’s EV growth aligns with corporate fleets upgrading to sustainable yet executive-friendly cars. Beyond that, BMW’s ability to merge performance with practicality – while tapping into its loyal customer base – has made it one of the most consistent EV performers in Europe’s competitive landscape.

4) Audi

Q1 Sales: 34,739 (+51%)

Audi’s EV lineup, led by the Q4 e-tron and Q8 e-tron, appeals to both business buyers and families looking for reliability. Its mix of premium interiors, high safety standards, and solid range figures has helped Audi climb higher in the rankings in 2025.

By combining luxury appeal with advanced connectivity features and strong dealer support, Electric Car Brands like Audi have become serious players in Europe’s EV market, gaining traction with customers who want both style and substance.

5) Renault

Q1 Sales: 31,880 (+89%)

Renault has long been one of Europe’s pioneers in electrification, and 2025 has strengthened that legacy. The Megane E-Tech and Zoe continue to dominate urban mobility markets. Renault’s accessible price points make it one of the most popular EV choices for middle-income families.

Coupled with its extensive dealer network and efforts to introduce practical charging solutions, Renault is cementing itself as a trusted name for budget-conscious buyers seeking proven electric mobility.

6) Kia

Q1 Sales: 28,950 (+59%)

Kia’s bold designs and high-tech features have propelled the EV6 and Niro EV into Europe’s best-selling list. Known for impressive charging speeds and long warranties, Kia has successfully repositioned itself from a budget brand to a serious EV contender.

With a focus on value, design, and next-gen technology like ultra-fast EV charging, Kia continues to draw attention from younger buyers and families alike, helping it expand rapidly across Europe.

7) Mercedes

Q1 Sales: 28,375 (+6%)

Electric Car Brands like Mercedes-Benz have transitioned many loyal combustion buyers into their EQ range. With models like the EQB, EQE, and EQS, Mercedes caters to premium buyers who prioritize comfort, luxury, and advanced driver assistance systems.

It has managed slow but steady growth in 2025. Mercedes’ commitment to offering cutting-edge interiors, smooth driving experiences, and strong brand prestige makes it one of the top choices for EV buyers seeking uncompromised luxury.

8) Skoda

Q1 Sales: 26,578 (+93%)

Skoda’s Enyaq iV remains a strong performer, capturing customers who want affordability and practicality without compromising on space. Skoda’s expansion in Eastern and Central Europe is also driving strong adoption.

By maintaining its value-for-money reputation and expanding charging partnerships, Skoda has effectively positioned itself as the go-to EV brand for families looking for reliability and comfort on a reasonable budget.

9) Peugeot

Q1 Sales: 24,397 (+8%)

Peugeot’s e-208 and e-2008 compact models keep it competitive, especially for city commuters. Affordable leasing deals and efficient battery packs have secured Peugeot’s steady growth across European urban centers.

With attractive design, energy efficiency, and a focus on affordability, Peugeot is carving out its place in the EV market, appealing particularly to urban drivers and young professionals who want stylish yet practical electric cars.

10) Volvo

Q1 Sales: 22,810 (-30%)

Volvo’s XC40 Recharge and C40 Recharge remain popular choices in Europe, yet 2025 saw a noticeable decline in new registrations compared to last year.

Despite this slowdown, Volvo continues to rely on its strong reputation for safety innovations and sleek Scandinavian design, which keeps it competitive and relevant among premium EV buyers who prioritize trust, family security, and timeless aesthetics.

11) Hyundai

Q1 Sales: 21,286 (+28%)

Hyundai’s Ioniq 5 and Ioniq 6 have impressed buyers with futuristic styling, ultra-fast charging capability, and long driving ranges that rival top European brands.

The company’s strategy of delivering advanced tech at highly competitive price points is paying off, especially with eco-conscious families seeking affordable yet premium-feeling Electric Car Brands. Hyundai has firmly positioned itself as a global player challenging established automakers across multiple segments.

12) Cupra

Q1 Sales: 18,878 (+179%)

Cupra, SEAT’s performance-driven sub-brand, has taken an enormous leap forward in 2025, largely fueled by the growing popularity of the Born. With sharp styling, youthful branding, and sporty acceleration, Cupra appeals to a younger demographic that wants EVs to feel exciting and dynamic rather than just efficient.

Its growth highlights a shift toward emotional design and driving fun in the electric car market.

13) BYD

Q1 Sales: 17,729 (+133%)

China’s BYD has disrupted the European EV market in a big way, offering models with excellent range, high-tech interiors, and very competitive pricing. Entry-level cars like the Dolphin and premium models like the Han are proving that Chinese automakers are no longer niche players but serious contenders.

BYD’s rapid growth showcases how affordability, innovation, and global ambition are reshaping the European EV landscape.

14) Citroen

Q1 Sales: 16,367 (+161%)

Citroen’s ë-C4 and ë-C4 Aircross have experienced a dramatic sales surge in 2025, more than doubling compared to last year. Known for their comfort-focused design and accessible pricing, Citroen’s EVs appeal strongly to budget-conscious families and everyday drivers.

The Electric Car Brands’ success shows that affordability without sacrificing practicality or driving comfort is a formula that resonates widely with European customers seeking reliable, entry-level EV options.

15) Mini

Q1 Sales: 14,448 (+545%)

Mini’s electric resurgence is nothing short of impressive, with the latest Mini Cooper SE driving nearly all of this extraordinary growth. Combining nostalgia, iconic design, and playful handling, Mini EVs have become especially popular in densely populated European cities like London, Paris, and Berlin.

Their compact size and lively personality make them a perfect fit for urban lifestyles, blending heritage charm with modern electric mobility.

16) Opel/Vauxhall

Q1 Sales: 13,612 (+23%)

Opel (Vauxhall in the UK) continues to gain with its Corsa-e and Mokka-e, offering affordability and accessibility.

Younger drivers and city dwellers widely adopt these models due to their compact size, efficient range, and practical everyday usability. Opel/Vauxhall has positioned itself as a reliable option for those transitioning to EVs without breaking the bank.

17) Ford

Q1 Sales: 13,103 (+160%)

Ford’s Mustang Mach-E has cemented its reputation as a high-performance EV, while the Explorer EV boosts Ford’s family car segment. Ford is proving that it can still capture attention in Europe’s competitive EV landscape by combining strong brand heritage with modern technology.

Its ability to cater to both performance enthusiasts and families has helped Ford’s sales momentum accelerate rapidly.

18) Dacia

Q1 Sales: 11,315 (+46%)

Dacia’s Spring EV has become Europe’s most budget-friendly electric car. While it doesn’t offer the range of premium competitors, its low price point has won over thousands of entry-level EV buyers.

The Spring’s popularity highlights a growing demand for affordable urban mobility solutions, especially among cost-conscious drivers who prioritize practicality and value over advanced features.

19) MG

Q1 Sales: 10,163 (-47%)

MG is facing a slowdown in 2025, but models like the MG4 and MG5 still make it a value-for-money brand. With a solid range at affordable pricing, MG remains competitive in the UK and EU.

The company’s challenge lies in maintaining market share against aggressive newcomers, but its reputation for practicality and affordability continues to attract a loyal customer base.

20) Toyota

Q1 Sales: 10,106 (+27%)

Toyota is catching up with the bZ4X, finally making a dent in the EV market. Known for its hybrid legacy, Toyota’s full-electric offerings are slowly gaining traction in Europe.

The Electric Car Brands’ strong customer trust and global footprint give it an edge, and with new EV models in the pipeline, Toyota is expected to play a much bigger role in the coming years.

Why Charging Infrastructure Matters

These Electric Car Brands would not thrive without reliable charging. The surge in BEVs highlights the equal importance of ev chargers, both at home and commercially. In the UK, OZEV EV Charger schemes make adoption easier for households and businesses. Whether it’s a smart EV charger for scheduling, AC EV chargers for daily overnight charging, or DC EV chargers for highway networks, the infrastructure must keep pace.

Residential EV charger manufacturers ensure smooth charging at home, while commercial EV charger manufacturers equip workplaces, malls, and fleets. As EV sales rise, demand for ev charger suppliers delivering both Fast EV Chargers and Super Fast EV Chargers grows rapidly.

CITA EV Charger – Powering the EV Movement

As Europe embraces these 20 best-selling Electric Car Brands, charging becomes the backbone of this transformation. Reliable chargers ensure drivers enjoy the performance, savings, and sustainability they were promised when buying an EV.

This is where CITA EV Charger align perfectly with the future of electric mobility. With AC chargers (7kW & 22kW, IP65 & IK10 rated), 44kW dual EV chargers, and Fast to Ultra Fast DC chargers (60–360 kW, IP54 & IP55 rated), CITA ensures every EV – from Teslas to Renaults – can be powered safely.

Our UKCA- and CE-certified solutions, paired with the CITA EV App and CPMS, deliver both residential and commercial reliability. Add installation support, extendable warranties, and service across 35+ countries, and it’s clear how charging integrates into the bigger EV adoption story.

Future-proof your Tesla, VW, or BMW with our Certified EV Chargers.

Invest in Smart EV Chargers for flexible, cost-efficient home or commercial EV charging.

Explore our range of Fast EV Chargers and Super Fast EV Chargers that match Europe’s leading Electric Car Brands.

The EV revolution isn’t just about the car – it’s about the ecosystem that keeps it moving. Choosing the right EV is step one. Pairing it with the right charger is what makes the journey seamless.